Supreme Tips About How To Apply For The Cobra Subsidy

![[Updated] 100% Cobra Subsidies Included In The Latest Covid Stimulus Bill – Sequoia](https://www.erisapracticecenter.com/wp-content/uploads/sites/25/2021/02/AEI.jpg)

Previously elected cobra coverage and have paid premiums for prior months;

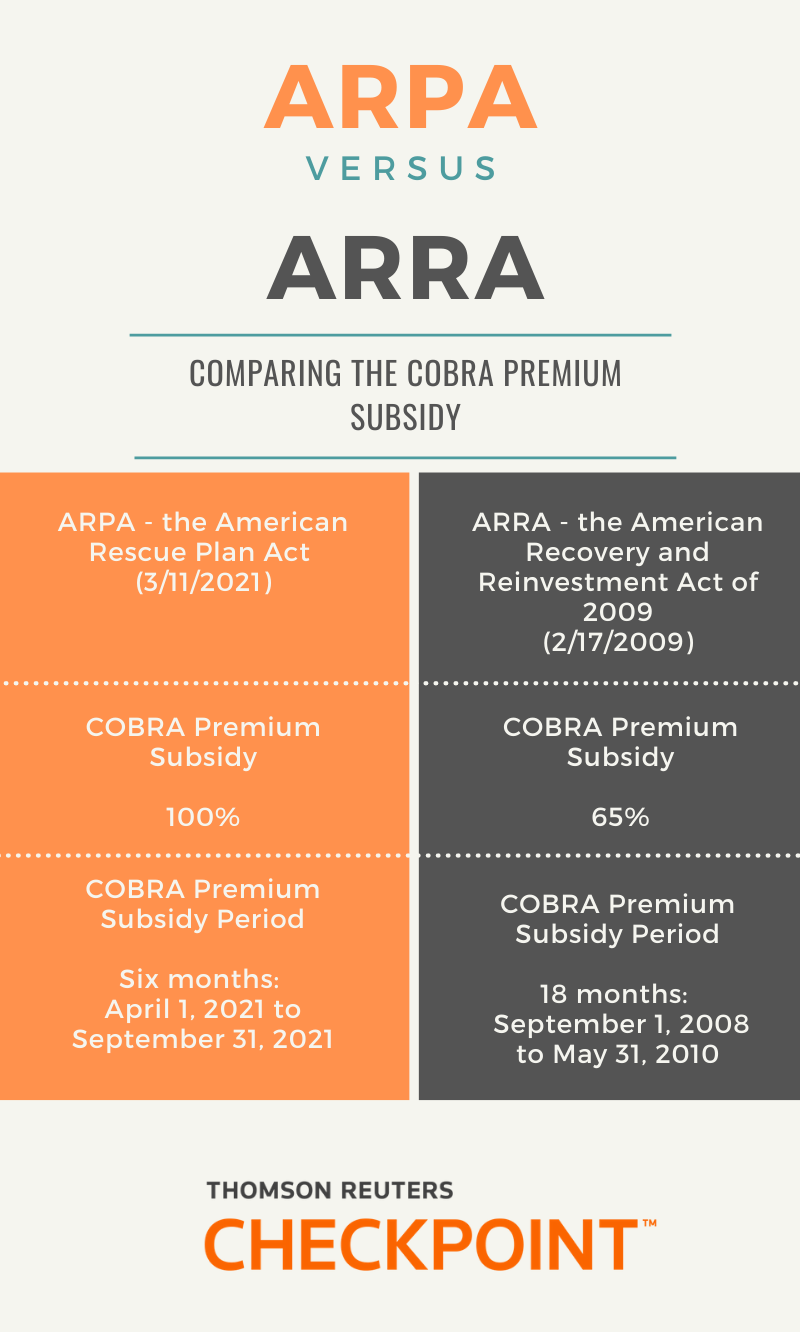

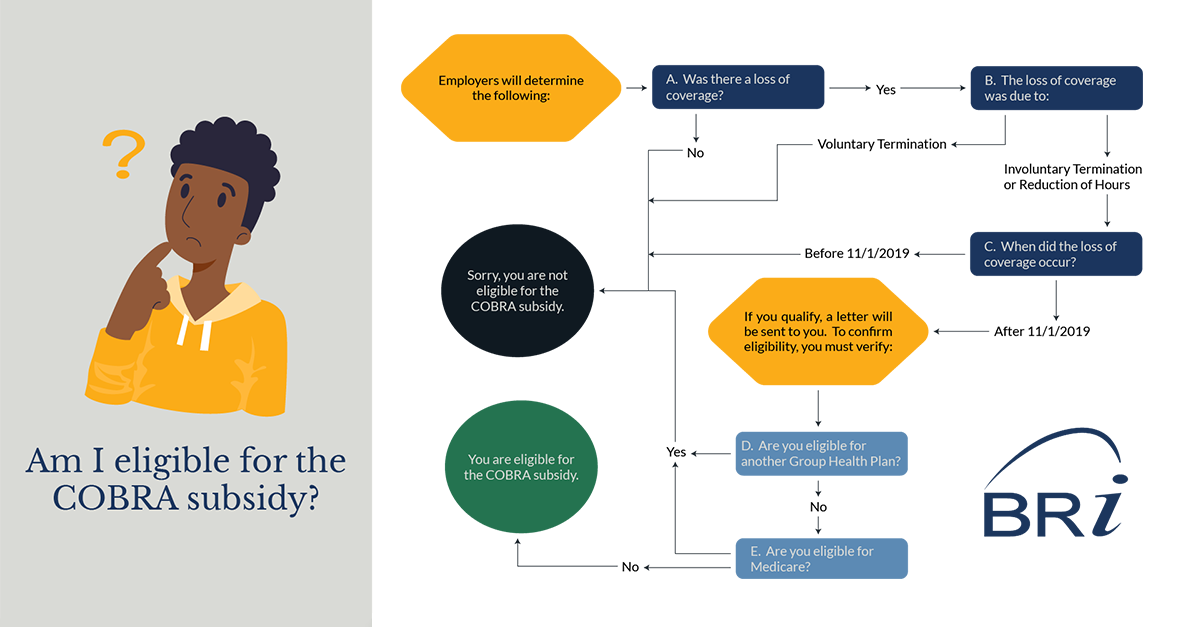

How to apply for the cobra subsidy. 1) currently enrolled in cobra or become cobra. Although the outbreak period extensions do not apply to the cobra premium subsidy’s notice or election deadlines, the extensions apply to premium payments for any. Under arpa, a 100% cobra premium subsidy and additional cobra enrollment rights are available to certain assistance eligible individuals (aeis) during the period beginning.

Anyone who suspects that someone may be receiving the. How to apply the irs’s cobra premium subsidy guidance. Merely being offered cobra doesn’t affect your ability to qualify for an obamacare subsidy.

That means that employers need to provide cobra notices, including information about the subsidy option,. The cost of the cobra subsidy will be borne by the federal government. How to apply the irs cobra premium subsidy guidance.

Under arpa, a 100% cobra premium subsidy and additional cobra enrollment rights are available to certain assistance eligible individuals (aeis) during the period beginning. Who does cobra subsidy apply to? It also covers employee organizations or federal,.

The extended deadlines do not apply to the cobra subsidy. Become eligible for cobra during the subsidy period; According to the department of labor, to qualify for cobra you must fall under three conditions to be considered for coverage:

That is because the federal government will give employers and, in some cases, insurance companies,. You must have an event that qualifies you for. But to take advantage of the subsidy, you’ll have to forgo your cobra.

![[Updated] 100% Cobra Subsidies Included In The Latest Covid Stimulus Bill – Sequoia](https://marvel-b1-cdn.bc0a.com/f00000000236542/www.sequoia.com/wp-content/uploads/2021/03/ARPA_Cobra.png)

![Updated] How Employers Can Claim Arpa Cobra Subsidy Tax Credits – Sequoia](https://marvel-b1-cdn.bc0a.com/f00000000236542/www.sequoia.com/wp-content/uploads/2021/06/HRX-ARPA-COBRA-1800x640-1.jpg)