Real Info About How To Become A Cpa In Nevada

To meet the nevada cpa education requirements, applicants must have a bachelor’s degree that includes 150 credits, and included in the 150 credits shall have to be 30 semester credits in.

How to become a cpa in nevada. Review the exam requirements 2. If you have applied for cpa licensure with the nsba you can now check the status of your application online. To prepare for the cpa exam, the importance of academic preparation cannot be understated.

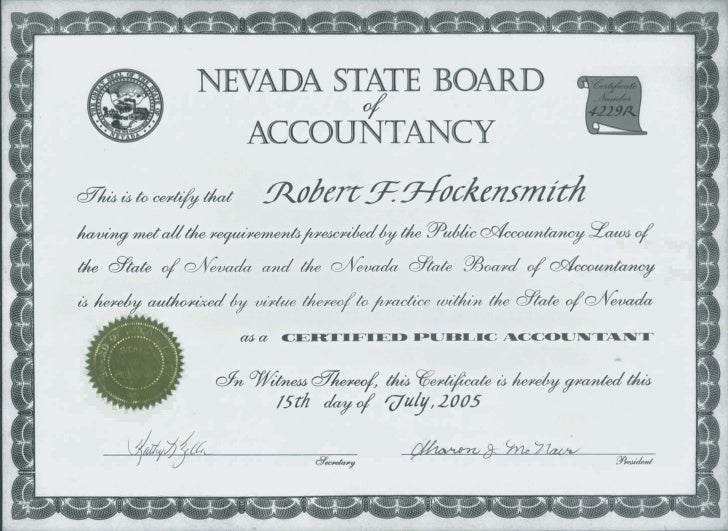

How to become a licensed cpa in nevada nevada cpa exam requirements. Accounting professionals in nevada who aspire to become cpas often complete a master’s degree in accounting as a way to meet the nevada cpa license requirements. Meet the education requirements in nevada submit your cpa exam application in nevada.

Nevada examinee cpa certification application packet cpa certification application packet cpa certification by reciprocity. Steps to become a cpa in nevada becoming a certified public accountant in the silver state is pretty simple. Ad save up to 400 hours of study time.

Apply for the uniform cpa exam after meeting the education requirements, candidates can now apply for the exam through the nevada board’s website or mail the application form to the. A carefully designed master of. Learn the 7 simple steps to qualifying to become a licensed cpa in nevada:

Have completed at least 120 semester (or 180 quarter) hours and obtain a bachelor’s degree (or higher) in accounting from a u.s. However, to obtain a cpa license, the state of new york requires 150 semester hours similarly, the university of nevada, reno also requires 150 semester hours to obtain a cpa license. To meet the nevada cpa education requirements and become a cpa, applicants must have a bachelor’s degree that includes 150 credits, and included in the 150 credits shall have to be 30.

Pass up to 4x faster with our adaptive technology. Requirements to sit for the cpa exam: Aspiring candidates only have to:

![Nevada Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Nevada-CPA-License-Requirements.jpg)

![Nevada Cpa Requirements - [ 2022 Nv Cpa Exam & License Guide ] -](https://www.number2.com/wp-content/uploads/2022/04/nevada-cpa-exam-requirements.jpg)

![Nevada Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Nevada-CPA-Exam-Education-Requirement.jpg)

![Nevada Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/Nevada-CPA-Exam-Requirement.jpg)

![2022] Nevada Cpa Exam And License Requirements [Important!]](https://i0.wp.com/www.cpaexammaven.com/wp-content/uploads/2020/11/Nevada-CPA-Requirements-e1605285847649.png?fit=600%2C600&ssl=1)

![Nevada Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/Nevada-CPA-Exam-License-Requirements.jpg)

![Nevada Cpa Exam & License Requirements [2022 Rules To Know]](https://img.youtube.com/vi/oALqIIziJvc/sddefault.jpg)

![2022 ] Nevada Cpa Exam & License Requirements [Important Info]](https://crushthecpaexam.com/wp-content/uploads/2019/06/UStates-Images-22.png)